As companies expand their operations across the United States, compliance with state-specific regulations becomes an increasingly important part of doing business. For organizations working in California, one rule that often raises questions is the state’s nonresident tax withholding requirement. This regulation applies when paying vendors based outside California for services performed within the state, and it carries specific thresholds and conditions that businesses must meet.

In this post, we’ll walk through the essentials of California’s nonresident tax withholding policy and highlight practical ways businesses can stay compliant while keeping vendor relationships and financial processes running smoothly.

What is California Nonresident Tax Withholding?

California law requires businesses to withhold 7% on payments made to nonresident vendors—those operating outside the state without a valid California business license—when those vendors provide services within California. The rule applies only once total payments to a vendor exceed $1,500 in a calendar year. For example, if a New York–based consultant bills $20,000 for work performed in Los Angeles, the hiring company must withhold $1,400 and remit it to the Franchise Tax Board.

While the policy may seem straightforward, businesses often overlook details such as the cumulative threshold or vendor exemptions, which can trigger compliance issues. Staying attentive to these requirements not only reduces the risk of penalties and audits but also ensures smoother financial transactions and more transparent vendor relationships.

Key Features of BQE CORE's Nonresident Tax Withholding Feature

To help businesses manage their compliance responsibilities effectively, several features can streamline the California nonresident tax withholding process. Here’s an overview:

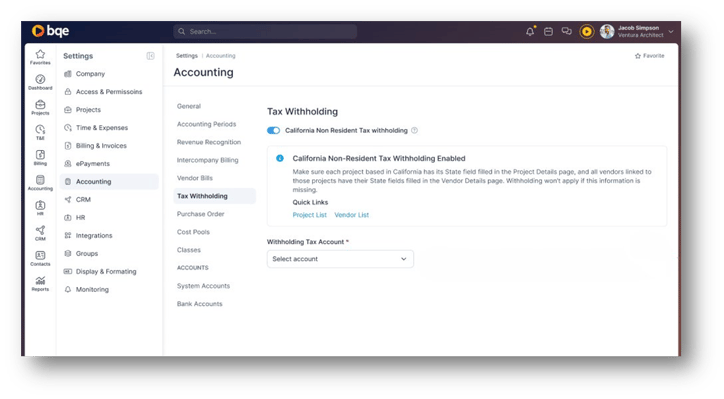

Configurable Withholding Settings

Businesses can toggle the California nonresident tax withholding feature on or off, with the default setting initially off. This flexibility enables companies to assess their vendor landscape and activate withholding on a case-by-case basis, reducing the chance of confusion and preventing unnecessary withholding.

State-Specific Requirements

Proper application of the withholding depends on accurate vendor and project details, including state information. A comprehensive user guide will help businesses understand the prerequisites for compliance, featuring a direct link to the Vendor or Project list for easy updates, whether individually or in bulk.

Clear Tax Withholding Calculations

Transparency is crucial in financial transactions. Each line item on vendor bills will include a dedicated Tax Withholding column that automatically calculates the 7% withholding from the total payment amount, ensuring accuracy. This calculation occurs only if specific conditions are met: the service checkbox is checked, the vendor's address is outside California, and the project address is located within the state. If these criteria are unmet, the withholding field will show zero.

Automated Journal Entries

Upon approving vendor bills that involve tax withholding, the system will automatically generate corresponding journal entries capturing the withholding amounts. This automation eliminates manual data entry errors and saves significant time for finance teams, ensuring accurate financial reporting.

Timely Payment Reminders

Timely payment of taxes is a critical aspect of compliance. The system will send users automated reminders for upcoming tax payment deadlines, guided by the schedule outlined in the Franchise Tax Board - Withholding Tax at Source Requirements (Publication 1017). This proactive approach helps mitigate the risk of late fees or penalties for non-compliance.

Opt-Out Flexibility for Vendors

Recognizing that some vendors may prefer to manage their tax obligations independently, businesses will have options for opting out of automatic withholding. Users can uncheck the tax withholding option on the Vendor Details Page or perform a mass opt-out for multiple vendors simultaneously through the Batch Update feature. This capability ensures that companies can meet the diverse needs of their vendor base.

Conclusion

With the rollout of these solutions, businesses can look forward to a more streamlined and reliable way to manage California’s nonresident tax withholding requirements. By reducing manual effort and ensuring accuracy, these enhancements not only ease the compliance burden but also strengthen overall financial operations.

For firms operating in California, staying informed is more than a regulatory checkbox—it’s a strategic necessity. Missteps in withholding can disrupt vendor relationships, create cash flow challenges, and expose organizations to costly audits. By addressing these requirements with the right systems in place, companies protect themselves while also demonstrating accountability and professionalism to partners, strengthening their reputation in the market.

Adopting a proactive approach today ensures your business is prepared not only for California’s rules but also for the growing trend of state-level tax complexity nationwide. Staying ahead of these requirements safeguards financial health, preserves trust with vendors, and positions your firm as one that manages compliance with confidence.

Ultimately, embracing these changes is not just about avoiding penalties. It’s an opportunity to strengthen processes, build resilience, and establish your company as a trusted and well-managed organization in an increasingly competitive marketplace.

-Apr-04-2023-08-25-30-5610-PM.png?width=2240&height=1260&name=Blog%20Banners%20(3)-Apr-04-2023-08-25-30-5610-PM.png)

-4.png?width=2240&height=1260&name=Blog%20Banners%20(5)-4.png)

-Feb-17-2023-05-32-38-0189-AM.png?width=2240&height=1260&name=Blog%20Banners%20(3)-Feb-17-2023-05-32-38-0189-AM.png)